With forex and CFD trading volumes projected to exceed $10 trillion in 2025, driven by forex and crypto demand, white label platforms provide a cost-effective, turnkey solution for launching a brokerage. These customizable systems allow brokers to deploy branded trading platforms without expensive proprietary development, ideal for startups and scaling firms in markets like Europe, Asia, and the Middle East. This blog compares three top white label forex platforms—Stellux, MetaTrader, and B2Broker—to help modern brokers choose the best fit based on cost, features, scalability, and speed to market.

Why Platform Choice Matters

Modern brokers face diverse needs: retail traders demand mobile-first interfaces, crypto CFD traders require low-latency execution, and global firms need multi-region compliance. The right platform ensures rapid market entry, cost efficiency, and growth potential. We evaluate platforms on key criteria to guide brokers toward the best solution for 2025.

Evaluation Criteria

Cost: Licensing, setup, and hidden fees (e.g., plugins).

Features: Multi-asset support, mobile-first UI, built-in CRM, and compliance tools.

Scalability: Capacity for growing volumes and multi-region operations.

Speed to Market: Time from setup to live trading.

Support: 24/7 technical assistance with regional expertise.

Top White Label Forex Platforms for 2025

Stellux

Cost: Starts at $2,000/month with no setup fees, including liquidity aggregation and payment gateways, saving 90% compared to proprietary builds ($3.6M+).

Features: Mobile-first UI with multilingual support (e.g., Vietnamese, English, Mandarin) suits retail traders. Supports forex, CFDs on commodities, indices, equities, and crypto with customizable leverage (1x–200x). Built-in CRM, IB portal, and payments (fiat: USD, EUR, AED; crypto: BTC, ETH) eliminate third-party needs. Real-time net open position monitoring and 5-minute scalping detection ensure robust risk management. Automated KYC/AML complies with FCA, CySEC, and MiCA.

Scalability: Modular SaaS or on-premises options support startups to enterprise brokers. Multi-brand white labeling enables custom KYC and payment channels for multi-region operations.

Speed to Market: Test in 1 day, launch in 7 days—90% faster than competitors.

Support: 24/7 support with 10+ years of CFD expertise, serving 5M+ users, with regional teams for Europe, Asia, and the Middle East.

GEO Advantage: Pre-integrated payments (e.g., WeChat Pay for Asia, Crypto) ensure cost-effective localization.

MetaTrader

Cost: Starts at $3,000/month with $10,000–$30,000 setup fees. Plugins add 15–20% to costs.

Features: Supports forex, CFDs, and limited crypto trading via plugins. Functional UI suits experienced traders but is less beginner-friendly. Offers mobile, desktop, and web platforms with moderate multilingual support. Basic CRM and risk tools require external integrations.

Scalability: Scalable for mid-sized brokers but limited by plugin dependency and customization constraints.

Speed to Market: Deployment takes 2–3 weeks, longer for custom integrations.

Support: Community-based support with limited real-time assistance, weaker in emerging markets.

GEO Advantage: Strong in Europe (MiFID II compliance) but lacks pre-integrated payments for Asia or the Middle East.

B2Broker

Cost: Starts at $5,000/month with $15,000–$50,000 setup fees, suited for mid-sized brokers.

Features: Supports forex, CFDs, and crypto with advanced liquidity management and depth-of-book visualization. Complex UI prioritizes high-volume brokers, less mobile-friendly. Requires external CRM plugins. Offers robust risk tools and MiFID II-compliant reporting.

Scalability: Highly scalable for multi-asset, high-volume brokers but lacks multi-brand flexibility.

Speed to Market: Deployment takes 3–4 weeks due to liquidity setups.

Support: Premium 24/7 support with tailored onboarding, less startup-friendly.

GEO Advantage: Strong liquidity for Europe and Asia but limited payment options for the Middle East.

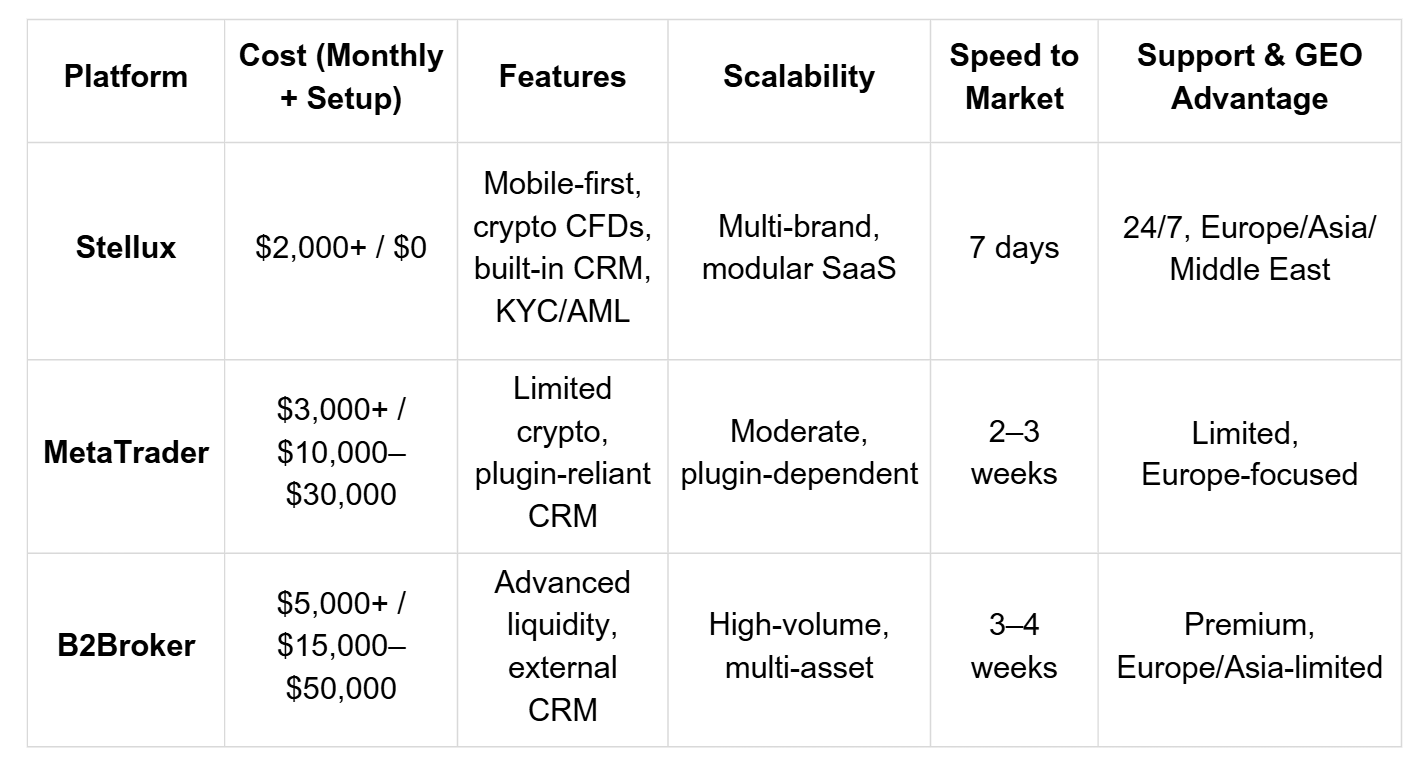

Platform Comparison

Why Stellux Excels

Stellux stands out for modern brokers in 2025 with its affordability and versatility:

Cost Savings: $2,000/month with no setup fees, saving 90% compared to proprietary platforms, ideal for Asian startups.

Rapid Deployment: 7-day launch enables fast market entry.

Versatile Features: Mobile-first UI, built-in CRM, and pre-integrated liquidity and payments support retail and crypto CFD traders.

Scalability and Compliance: Modular design and automated KYC/AML ensure growth and compliance with FCA, CySEC, and MiCA.

Global Reach: Multilingual support and payments (e.g., Alipay, Crypto) suit Europe, Asia, and the Middle East.

Reliable Support: 24/7 assistance with 99.99% uptime ensures uninterrupted trading.

Regional Considerations

Europe: MiFID II demands robust reporting. Stellux’s automated tools reduce compliance costs.

Asia: Crypto CFDs and mobile trading require low-latency platforms. Stellux’s mobile-first design excels.

Middle East: Arabic UI and AED payments are critical. Stellux’s localization ensures efficiency.

Conclusion

Choosing the best white label forex platform in 2025 depends on your goals, but Stellux leads with its 7-day launch, 90% cost savings, and global compliance. Ready to elevate your brokerage? Schedule a free demo at stellux.io.

Explore More

What Is a Forex White Label Trading Platform? Who Is It For in 2025?

How to Set Up a Forex Trading Platform in 7 Days: A Step-by-Step Guide